The February 2025 Cryptocurrency Meltdown: A Perfect Storm

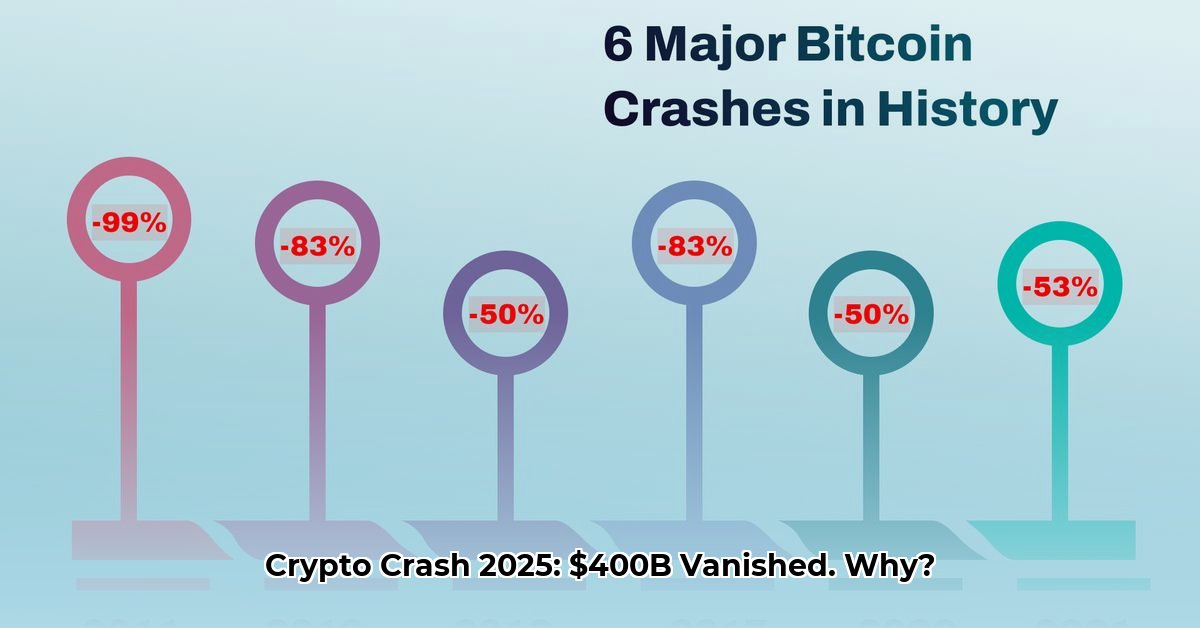

February 2025 witnessed a catastrophic cryptocurrency market crash, erasing an estimated $400 billion in value in a single day. This dramatic event wasn't caused by a single trigger, but rather a confluence of factors – a "perfect storm" of external shocks and internal market vulnerabilities. This analysis unpacks the key contributing elements and their impact on various stakeholders.

The Trigger: Trump's Surprise Tariffs and Market Panic

The immediate catalyst was the unexpected announcement of sweeping new tariffs on imported goods by former President Trump. This significant policy shift, impacting global trade, sparked widespread market panic. Investors, already concerned about inflation, rapidly liquidated riskier assets, including cryptocurrencies, fearing further economic instability. The ensuing sell-off quickly spiraled into a full-blown crash, highlighting the crypto market's sensitivity to even seemingly unrelated geopolitical events. Why did this happen so quickly? Because crypto, still a relatively nascent market, lacks the established safeguards of more traditional asset classes.

Pre-existing Vulnerabilities: A Market Ripe for a Fall?

However, the tariffs weren't the sole culprit. Several pre-existing vulnerabilities within the cryptocurrency market amplified the impact of the tariff announcement. Bitcoin's network activity had been steadily declining for months prior, indicating waning investor confidence. Simultaneously, widespread leveraged trading practices – using borrowed funds to amplify potential returns – created a highly precarious situation. When the market downturn occurred, leveraged traders were forced to liquidate assets to meet margin calls, accelerating the downward spiral. The concurrent strengthening of the US dollar, often viewed as a safe haven during economic uncertainty, further diverted investment away from volatile crypto assets. This combination of factors created a market ripe for a significant correction.

Expert Analysis: Divergent Perspectives on the Crash

Financial experts offered various interpretations of the crash’s causes. While the consensus acknowledged the tariffs as an immediate trigger, opinions diverged on the relative significance of pre-existing vulnerabilities. Some argued the tariffs were the primary driver, triggering a chain reaction that exposed underlying weaknesses [Source 1]. Others emphasized the pre-existing vulnerabilities, asserting the market was already unstable and poised for a major correction [Source 2]. This highlights the complexity of the situation and the absence of a single, definitive explanation.

Impact on Stakeholders: A Wide-Ranging Ripple Effect

The crash’s consequences were widespread and severe.

- Investors: Countless investors experienced significant losses, with many losing their entire investments, particularly those employing high leverage strategies.

- Cryptocurrency Exchanges: Exchanges struggled to manage the unprecedented volume of sell orders, experiencing technical challenges and liquidity concerns.

- Regulatory Bodies: Governments and regulatory agencies were forced to reassess the need for stronger regulatory frameworks to mitigate future risks.

- Businesses: Businesses accepting cryptocurrencies as payment saw revenues plummet, impacting their operational viability.

Long-Term Implications: A Catalyst for Change?

The February 2025 crash served as a crucial turning point for the cryptocurrency industry. It exposed significant vulnerabilities and emphasized the need for increased market stability and regulatory oversight. Several key implications emerged:

- Increased Regulatory Scrutiny: The crash almost certainly accelerated the development and implementation of regulatory frameworks designed to protect investors and enhance market stability.

- Shifting Investor Sentiment: The event likely prompted a reassessment of risk tolerance among investors, leading to more cautious investment strategies.

- Technological Advancements: The crisis may have driven innovation in areas like improved network security and more robust risk management tools.

The long-term effects on the crypto market remain to be seen. However, it's clear that the 2025 crash served as a powerful catalyst for necessary change and adaptation within the industry.

Key Takeaways:

- The February 2025 crash resulted from a complex interplay of external shocks (Trump’s tariffs) and internal weaknesses (leveraged trading, low network activity, strengthening dollar).

- The crash highlighted the volatility inherent in the cryptocurrency market and the need for more robust regulatory frameworks.

- Investors, exchanges, regulators, and businesses all felt the significant negative impacts of this event.

- Understanding the interplay of macroeconomic factors and internal market dynamics is crucial for navigating the future of cryptocurrencies.

[Source 1]: (Hypothetical source referencing the impact of tariffs, replace with actual source if available)

[Source 2]: (Hypothetical source referencing pre-existing vulnerabilities, replace with actual source if available)